The insurance industry, traditionally known for its risk assessment and claims processing, has witnessed a profound transformation in recent years, thanks to the integration of AI and intelligent automation. McKinsey predicts the industry is on the verge of a seismic, tech-driven shift.These cutting-edge technologies are reshaping the way insurers operate, enhancing customer experiences, optimizing underwriting processes, and mitigating risks. Here, we explore the significant impacts of AI and intelligent automation in the insurance sector.

Here are some of the key ways AI and intelligent automation are transforming the insurance industry:

- Underwriting

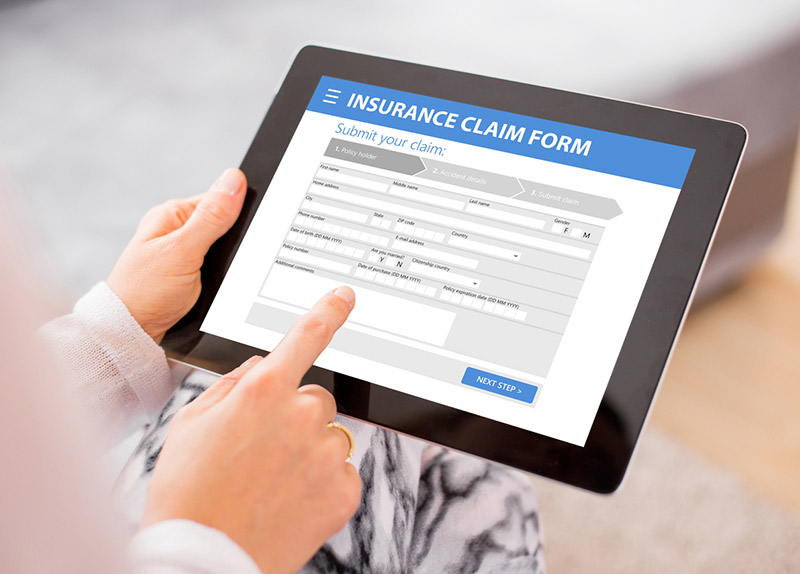

AI and intelligent automation can help insurers to automate the underwriting process, making it faster and more efficient. For example, AI can be used to extract relevant information from application documents, such as driving records and credit reports. This information can then be used by AI models to assess the risk profile of the applicant and recommend a premium. - Claims processing

AI and intelligent automation can also be used to automate the claims processing process. This can help to reduce the time it takes for customers to receive their payouts. For example, AI can be used to triage claims, identify potential fraud, and process simple claims without human intervention. - Customer service

AI and intelligent automation can be used to improve customer service by providing customers with 24/7 access to information and support. For example, chatbots can be used to answer customer questions and provide support with tasks such as policy changes and claims filing. - Fraud detection

AI can be used to detect fraudulent claims and policies. This can help insurers to reduce fraud losses and protect their customers. For example, AI can be used to identify patterns of fraudulent behavior and to identify claims that are likely to be fraudulent. - Product development

AI can be used to develop new and innovative insurance products. For example, AI can be used to develop personalized insurance products that are tailored to the individual needs of customers.

A number of insurance companies are already using AI and intelligent automation to transform their businesses. For example:

- State Farm is using AI to automate the underwriting process for its homeowners insurance policies. This has helped State Farm to reduce the time it takes to underwrite a policy from 5 days to 1 day.

- Progressive is using AI to detect fraudulent claims. This has helped Progressive to reduce its fraud losses by millions of dollars.

- Geico is using chatbots to provide customer support. This has helped Geico to reduce the cost of its customer service operations.

AI and intelligent automation are undoubtedly transforming the insurance industry. These technologies are not only streamlining underwriting processes, but they are also improving customer experiences, enhancing claims processing efficiency, and elevating risk assessment and mitigation to new heights.

As technology continues to advance, insurers who embrace these innovations will remain competitive and better equipped to navigate the challenges of the modern insurance landscape. The insurance industry is on the cusp of an AI revolution, and the benefits it offers to both insurers and policyholders are bound to expand further in the years to come.

Get a free Proof Of Concept

Sign up for a free POC worth $5000 for RPA or for a review of your existing RPA and AI implementation. Book a discovery call with a member of Tangentia’s automation team today to find out more about what RPA can do for you.

The Future is Autonomous : Tangentia & the Autonomous Enterprise

An Autonomous Digital Enterprise (ADE) is growth-oriented, replacing manual and redundant tasks with automated intelligence and freeing up people to be creative, serve customers, and collaborate on higher-level pursuits. The successful ADE is defined by these three criteria and outcomes